Freeman Law can assist with transfer Pricing Studies. A Transfer Pricing Study is the documentation that a taxpayer prepares to show that its transfer pricing was conducted at arm’s length. One manner to determine and document that the taxpayer selected the best method is to obtain a Transfer Pricing Study.

The taxpayer is required to be able to support the pricing method selected. Comparables are determined based on the degree of similarity in the functions performed and other factors including risks assumed, contractual terms, economic conditions, and property or services included in the transaction. Determining the best method depends on many factors including, but not limited to, the existence of comparable transactions and the degree of similarity of these comparables. There are transactional-based and profit-based methods. Parties in a controlled transaction are required to use the best method to determine the arm’s length price of goods sold between entities. The taxpayer must select the method that provides the most reliable measure of an arm’s length result taking into consideration all the data available. There is no per se hierarchy among these methods.

#ARMS LENGTH TRANSACTION PLUS#

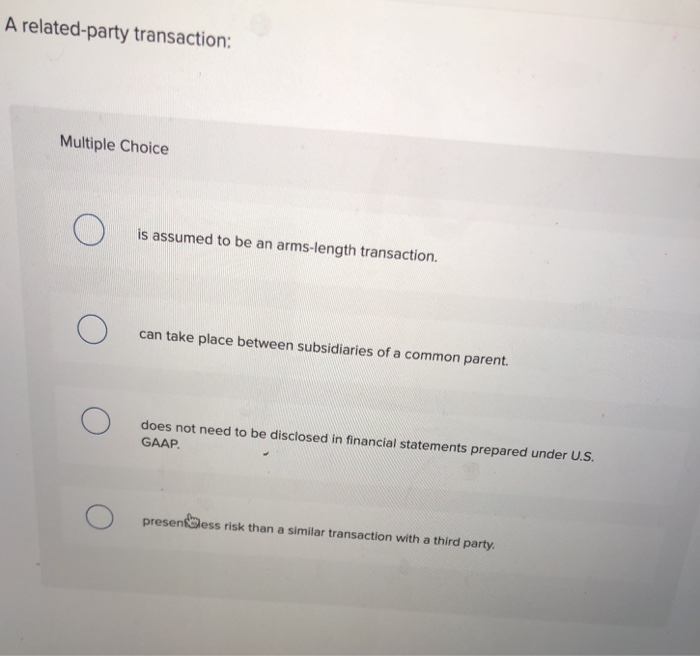

These include the Comparable Uncontrolled Price (CUP), Resale Price Method, Cost Plus Method, Comparable Profits Method (CPM) and various Profit Split Methods. There are various pricing methods available in the regulations under IRC I.R.C. Generally, allocations have been upheld by the courts unless the taxpayer can demonstrate that the IRS determination was arbitrary and capricious. Section 482 may apply where an allocation is necessary to:Īllocations affecting taxable income can be made to income, deductions, credits and other allowances. The regulations further provide that, “A presumption of control arises if income or deductions have been arbitrarily shifted.” Reallocation to Clearly Reflect Income The reality-not the form-of the control is decisive In addition, where two or more taxpayers act in concern or with a common goal or purpose, it may be sufficient to constitution “control” within the meaning of section I.R.C. § 482, whether the control is legally enforceable or not. That definition provides that any kind of control, direct or indirect, may give rise to “control” within the meaning of section I.R.C. § 482-1(i)(4) provides a broad definition of what constitutes control. What Is “Control” For Section 482 Purposes? The arm’s-length standard applies to outbound and inbound transactions. Section 482 encompasses the so-called arm’s-length standard. § 482 envisions three basic requirements before it applies:ġ) Two or more organizations, trades or businesses Ģ) common ownership or control, either directly or indirectly andģ) An IRS determination that an allocation is necessary either to prevent evasion of taxes, or to clearly reflect the income of the entities. Section 482 allows the IRS to make adjustments and allocations in order to ensure that transactions clearly reflect income attributable to controlled transactions and to prevent the evasion of taxes. When Does Section 482’s Arm’s Length Standard Apply? § 482 provides the IRS with the authority to make adjustments by reallocating items of gross income, deductions, credits, or allowances in order to properly reflect income between the entities. If the transfer price is not arm’s length, section I.R.C. This is, in essence, the “arm’s length standard,”-the price of the product that Parent charges its CFC should be the same as it would charge to an unrelated party for the same product under similar circumstances. § 482, controlled entities should price transactions in the same way that uncontrolled entities would under similar circumstances. § 482 requires Parent to sell that product at an arm’s length price to its CFC. For example, when a US parent (Parent) sells a product to its controlled foreign corporation (CFC), I.R.C.

The concept of “transfer pricing” relates to the pricing of transactions between controlled entities. Section 482 and the Arm’s-Length Standard

0 kommentar(er)

0 kommentar(er)